August 6, 2016

Thank You for your support of InternalTrends

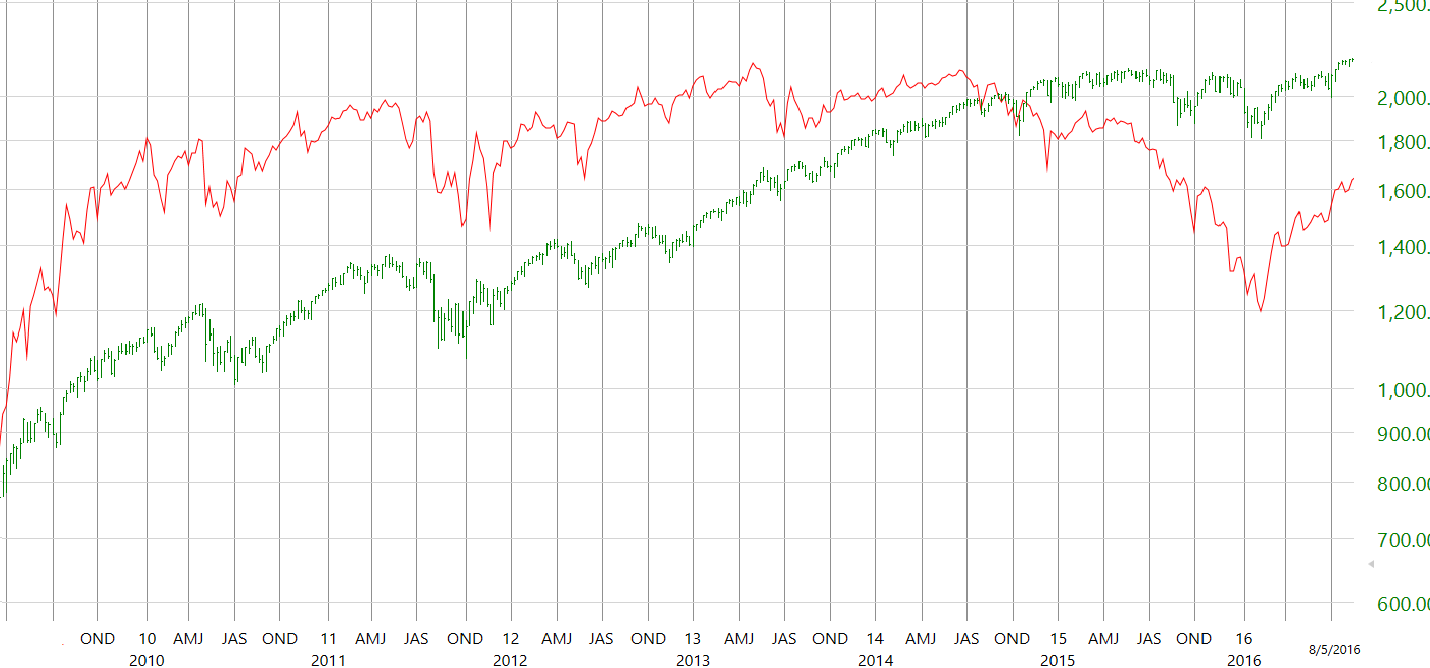

Ok … the VERY BIG PICTURE in a few words. From 2009 to 2013, equities benefited from lower interest rates: Beginning in 2013, a trend toward fearing higher interest rates began; this trend was amplified in late 2014 with the end of the Federal Reserve’s quantitative easing program, and 2015 saw continued deteriorating credit markets, particularly the High-Yield sector. Then the Fed raised rates in December 2015 and, to everyone’s surprise, rates plunged to historic lows, thus raising the concern of a new recession. So are we deteriorating into a period of lower rates, witness negative rates around the world, that will ultimately spell doom for economies and equities? Or might we transition to a period of more rapid economic growth that pulls us out of the downward rate spiral and into an environment where rising rates, due to economic growth and not run amok printing presses, are actually good for equities?

Until the launching of credit market ETFs (HYG, JNK, HYT, VWOB, LQD), it was a challenge to follow credit-market trends. But it is an important endeavor as the size of the credit markets dwarves equity-market valuation by a wide margin. So if you really want to follow the money, keep a eye on credit. To that end, in the following chart note that while there was evidence that the credit market, as measured by the High-Yield ETF HYG, was beginning to lag (deteriorate) as early as 2013, the trend accelerated in late 2014 when the Federal Reserve ceased its quantitative buying program.

As can be seen, each rally in the S&P 500 throughout 2015 was not confirmed by the credit-market ETFs. This emerging risk-off environment was also evidenced by progressive weakness in the small-cap Russell 2000 index. The advances in equity prices became so narrow in 2015 i.e., fewer and fewer stocks were going to new highs, that we saw the birth of the FANG acronym; an outsized portion of market gains were concentrated in just Facebook, Amazon, Netflix and Google (note: anytime a group gets a name, its dangerous). The weakness in the High-Yield sector was aggravated by the deteriorating energy complex wherein a lot of High-Yield debt resided. There was some debate, and confusion really, as to whether there was going to be a contagion effect beyond energy. This trend culminated when the Federal Reserve raised interest rates in mid-December 2015, but, as a surprise to many observers, yields promptly plunged, thus raising the specter of a collapsing economy; equity markets responded by collapsing in the Jan-Feb 2016 time frame. The credit market deterioration is quite evident in the following chart.

Green = S&P 500 and Red = High-Yield Debt (falling prices = higher yields)

Chart(s) courtesy of TC2000.com

From the bottom in February 2016, the credit markets have acted better, a complicating factor for bearish advisors. High Yield (HYG: JNK), Emerging Market Sovereign (VWOB) and Corporate Debt (LQD) have all “acted” well. It is, however, problematic from a short-term perspective that the credit markets were not confirming the S&P 500, Dow Industrials and Nasdaq Composite upside breakouts during the latter part of July and into early August. This lack of participation in the credit markets – and I’d add the Dow Transports sector – raise short term concerns.

Green = S&P 500 Red = High-Yield Debt (falling prices = higher yields) Blue = Dow Transportation

Chart(s) courtesy of TC2000.com

Bottom line: First, there is no reason to have a knee-jerk negative reaction to rising interest rates; in fact, rising interest rates resulting from economic strength should be welcomed. Just note the action on Friday August 5 when a strong employment report spurred stocks to strong gains and the largest one-day % gain in 10-year yields since February 6, 2015. And we note that the Atlanta Fed’s GDP forecast is now 3.8%, a rate of growth that should spark higher rates. It is problematic in the short term that the credit market complexes have not taken out their July highs in the face of the Dow Industrials, Nasdaq Composite and S&P 500 moving to all time highs. Though as important as the credit markets are, at this juncture where improving underlying fundamental economic activity is so important, it is a bit more problematic that the transportation sector is lagging so badly. For IF we are transitioning to a period where rising rates are not adverse for stocks as addressed in the BIG PICTURE above, it will be very important for Transportation stocks to begin showing confirming strength. And while the small cap Russell index suggest a willingness to take on greater risk, it remains 5% below its all time high of 1295.80. At this time there appears little reason for substantive portfolio changes, but we’d prefer to not be chasing strength right now; buying good companies at reasonable prices on pullbacks is always prudent, so have a shopping list of your favorite stocks handy. … consider monitoring the InternalTrends blog for interim updates.

Disclosure and Trading Policy

It should not be assumed that current recommendations will equal past performance or be profitable. The information presented has been obtained from sources believed to be reliable, but accuracy cannot be guaranteed. All material is subject to change without notice. Opinions offered are not personalized recommendations to buy, sell or hold securities. Officers, employees and affiliates of Roeing Research and Trading LLC may transact in Purchase and/or Sale Recommendations of the InternalTrends Blog or eNewsletter but not before the fourth day after the recommendation has been posted on the website; an exception being made for limit and/or stop orders that are not triggered at the time of dissemination. Securities mentioned in other parts of the eNewsletter or Blog may be bought or sold at any time.